Speeches

23 Oct 2024

Excellencies,

Distinguished Guests,

Ladies and Gentlemen,

- Good morning. I would like to extend a warm welcome and thanks to all delegates who are here today at the fourth edition of “Future of the Grid” conference, organised by Clarion Events Asia.

- Regional power grids are an important switch for Singapore’s power sector to achieve net-zero emissions by 2050. Projects such as the Lao PDR-Thailand-Malaysia-Singapore Power Integration Project have demonstrated the feasibility of multilateral and multidirectional electricity trade. Singapore has also issued additional Conditional Approvals and Conditional Licences to meet our increased import target of 6 gigawatts of low-carbon electricity by 2030.

- I am pleased to note that there will be a panel on ASEAN’s Regional Outlook for Subsea Interconnectors. Given that a large portion of Southeast Asia is an archipelagic zone, subsea cables that connect islands, countries and offshore resources will form the backbone of a nascent ASEAN power grid, enhancing energy resiliency and meeting growing demand for renewable energy.

- Let me share my perspective on this. The world’s two largest archipelagos are in this part of the world. Some may see this vast expanse of sea as an obstacle to connectivity. But the history of our region tells a different story – this region has been a crossroads of maritime trade since time immemorial. The sea itself has been used as an interconnector bringing trade and prosperity to regional communities and beyond. This region is not just a crossroads for trade but also a major highway for telecommunications. Economic development resulting from such connectivity has brought about a significant growth in air travel. Viewed within this context, these developments become a compelling narrative for regional efforts to realise our aspiration for a regional power grid.

- Within Singapore, domestic solar deployment is an important contributor to our net-zero aspirations. Singapore is well on its way to meeting our solar target of at least 2 gigawatts-peak by 2030. Our electricity fuel mix, which is predominantly made up of natural gas today, will comprise more solar and regional imports in the future. As much of the regional imports would come from solar, we could see them forming a larger share of peak electricity demand during daylight hours.

- Yes, our grid will become greener. But it would also be less stable. Today we have a highly flexible supply-side in the energy equation, contributed by dispatchable thermal assets. We will gradually begin to see a large share of non-dispatchable renewables. System peak events will increase, and the typical system stresses from generation tripping will continue. Added to this would be disruptions brought about by intermittency and bad weather.

- With an increasingly less flexible supply-side and the tendency for more system peaks, it is clear that the demand-side will have to step up to balance the energy equation.

- “Demand flexibility” is not a new concept. It describes the ability of electricity users to adapt their usage to balance the electricity supply-demand equation. The demand response programme, introduced in 2016, provides an incentive payment to any user who can scale back electricity consumption by at least 0.1 MW during periods of system stress, otherwise known as “activation periods”. But the large-scale coordination of millions of consumers, many with smaller loads, has been difficult to achieve in practice.

- Digitalisation will allow us to overcome this difficulty. More devices are now capable of being orchestrated to provide demand response without large infrastructure enhancements. According to a study commissioned by EMA, there is over 400MW of demand flexibility potential in Singapore. Commercial sectors, such as those reliant on heating, ventilation and air-conditioning, show significant potential for load shifting. Certain industrial processes, like those involving gas production, also offer opportunities for rescheduling operations to off-peak times.

- To capture this potential, EMA has introduced a regulatory sandbox in January 2023 with encouraging results. Our demand response capacity more than doubled from 46 MW to 103 MW. Demand response activations between 2023 and mid-2024 resulted in $700 million in savings for buyers in the Singapore Wholesale Electricity Market through reduced wholesale prices. Building on the positive outcomes of the sandbox, I would like to announce that EMA will mainstream the features from the sandbox into its regular demand response programme. EMA will also allow battery energy storage systems (or BESS) below 10MW to participate in the demand response programme.

- Yet another category of demand side assets that offer flexibility are electric vehicles. In the first 7 months of 2024 alone, electric vehicles comprised around 32% of new car registrations. By 2030, all new car registrations must be cleaner energy vehicles. According to the Singapore Integrated Transport and Energy Model developed by A*STAR’s Institute of High Performance Computing and TUMCREATE, with support from agencies such as EMA, LTA, S&TPPO, EVs are projected to account for approximately 5% of Singapore’s total electricity demand by 2040, with peak charging demand estimated at around 600 MW. This is a flexibility capacity to tap on that can bring benefits to the energy system if managed properly.

- DPM Gan has announced that EMA is working with ComfortDelGro to pilot the participation of EV charging stations in the DR programme via a regulatory sandbox. This will explore how ComfortDelGro’s network of charging stations can adjust charging patterns during DR activation periods and demonstrate how EVs can serve as flexible assets. Given that commercial fleets, such as those operated by ComfortDelGro, cannot totally avoid charging during peak periods due to operational needs, incentive payments for participation in DR will help mitigate charging costs. We will also apply this approach to EV chargers sited in commercial properties.

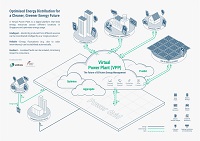

- EMA will also endeavour to increase demand flexibility by bringing together Distributed Energy Resources (DERs) such as solar, BESS, electric vehicles (or EVs). These DERs, when linked with smart energy management systems, can become Virtual Power Plants (VPPs), capable of providing energy and other ancillary services to the electricity market. We have seen the growth of VPP business models in areas of high penetration of renewables, such as Great Britain, California and the Eastern seaboard of Australia. Hundreds of smaller electricity consumers, including residential consumers, can be aggregated to orchestrate their roof-top PVs, thermal storage and battery packs to generate revenue.

- EMA recognises there are hurdles to integrating DERs into the electricity market. Their small size, distributed nature and the significant costs involved in setting up communications infrastructure have hindered their market participation. EMA is addressing these barriers through technical pilots and market aggregation models. EMA has launched a Request for Proposals for VPPs to explore their benefits under a regulatory sandbox. This is open to all interested parties. To kickstart this effort, EMA will work with SP Group to demonstrate a VPP pilot.

- Another energy asset class that bridges the demand and supply side are Battery Energy Storage Systems (BESS). BESS can provide grid stability, responding quickly to shifts in supply and demand while maintaining frequency and voltage control. In the World Energy Outlook 2024, IEA projected that global battery storage capacity is poised to almost triple by 2030. Singapore will have grid-level and distributed BESS in larger numbers than today, to address our growing domestic solar PV installations and as backups for power imports. But BESS currently is space intensive.

- Singapore has seen its first large-scale BESS deployed by Sembcorp and commissioned in six months in end-2022. Recognising that Singapore cannot afford to underutilise land use, EMA will collaborate with Sembcorp to find ways to reduce the land footprint of BESS. As the first-of-its-kind on land in Singapore, Sembcorp will stack BESS units and employ units that are twice as energy dense as existing ones.

- EMA has also launched its 2nd Energy Storage R&D Grant Call in 2023 to develop safer, denser, and more cost-effective energy storage solutions. I am pleased to announce that we will award grants totalling close to $8 million to two innovative energy storage R&D projects under the 2nd Energy Storage R&D Grant Call. First, Posh Electric will trial sodium-ion batteries. While currently more expensive than conventional lithium-ion batteries, these could become a cost-effective and safer alternative in the future. Second, VFlowTech will explore the feasibility of underground energy storage systems, optimising land use in Singapore.

- As we advance in our energy transition, our grid must evolve to handle the growing complexity of the system. With the deployment of more renewables, the grid often ends up as a chokepoint. Grid congestion and long upgrade times often hold up planting of new renewables projects. In some instances, transmission system operators have had to curtail renewables and run up gas-fired generators to preserve grid inertia.

- As we intensify our decarbonisations, dedicated infrastructure such as synchronous condensers and advanced inverters coupled with BESS can provide grid inertia. EMA will study the feasibility of using demand-side resources, such as industrial facilities with large rotating equipment, to perform the same function. We will explore these solutions through testbeds and collaborative projects with stakeholders.

- EMA has partnered SP Group to develop and publish Singapore’s “Future Grid Capabilities Roadmap” later this year. This will set out key focus areas of harnessing DERs to manage grid instability, enhancing grid planning, control and maintenance, and managing new system inertia needs. These new capabilities will then be progressively developed.

- The development of demand flexibility, DERs and grid transformation will play important roles in the energy transition. EMA will continue to explore regulatory enhancements and support evolving business models to drive demand-side participation in our power system. We encourage stakeholders to actively develop capabilities that will help support our initiatives. Together, we can collectively enhance our grid's stability and ensure a sustainable, secure power system for the future.

- Thank you for your participation.